BTC Price Prediction: October 2025 Peak in Sight Amidst Institutional Demand

#BTC

- Technical Outlook: BTC trades above 20-day MA but faces MACD bearish divergence

- Market Sentiment: Institutional accumulation vs. whale activity-induced volatility

- Price Target: $125K achievable post-breakout if hash rate growth sustains

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amidst Volatility

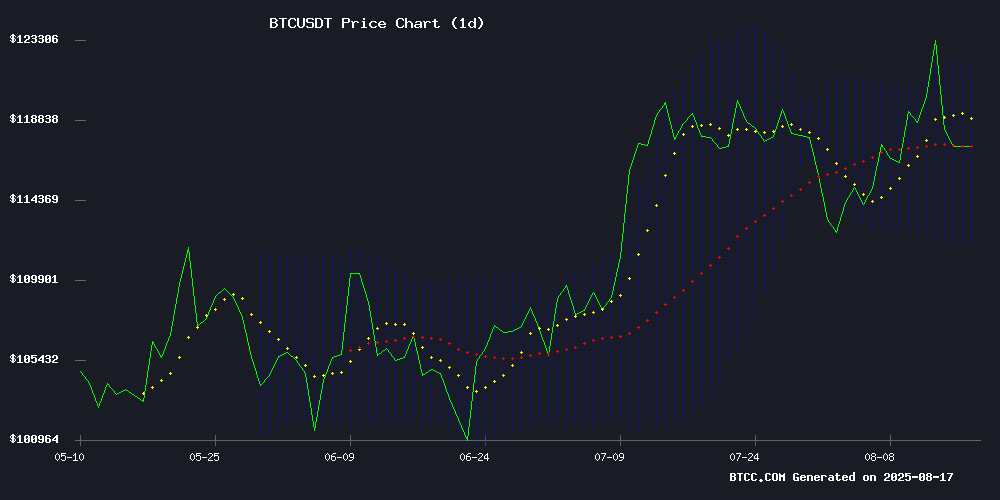

According to BTCC financial analyst John, Bitcoin (BTC) is currently trading at 118,067.36 USDT, above its 20-day moving average (MA) of 116,944.9970, indicating a potential bullish trend. The MACD indicator shows a bearish crossover with values at -1210.8731 (MACD line), 229.4277 (signal line), and -1440.3008 (histogram). However, the price remains within the Bollinger Bands (Upper: 121,881.6990, Middle: 116,944.9970, Lower: 112,008.2950), suggesting consolidation before a possible breakout. John notes that a sustained move above the 20-day MA could signal further upside.

Market Sentiment Mixed as Bitcoin Faces Key Resistance

BTCC financial analyst John highlights conflicting market sentiments based on recent news. Positive developments include Norway’s $1.7T wealth fund increasing bitcoin holdings by 83% and a Mexican billionaire considering an all-in Bitcoin bet. However, concerns arise from a sharp pullback after BTC briefly topped $123,000 and a dormant whale moving $353M in BTC. John emphasizes that while institutional adoption and hash rate ATHs support a $125K target, short-term volatility may persist.

Factors Influencing BTC’s Price

Bitcoin Battles for Independence by Surpassing Gold Threshold

Bitcoin's struggle to establish itself as an independent asset hinges on its ability to maintain a critical threshold against gold, according to Bloomberg Intelligence's Mike McGlone. The benchmark—approximately 35 ounces of gold—serves as a litmus test for Bitcoin's autonomy. Falling below this level would signal vulnerability, while holding above it could cement Bitcoin's divergence from speculative cycles.

On August 14, the BTC/XAU ratio briefly touched 36.9 ounces, though it has since retraced. This contrasts sharply with April's low of 24.7 ounces, a level that remains a cautionary marker for investors. Year-to-date, Bitcoin still lags gold by 0.41%, a marginal but telling gap that undermines claims of full decoupling.

McGlone, known for his tempered Bitcoin outlook, previously warned of a potential drop to $10,000. His current analysis frames the gold ratio as a binary catalyst: either Bitcoin breaks free or remains shackled to speculative forces.

Bitcoin Cycle Debate: Diverging Views on Market Top Timing

The cryptocurrency market faces a pivotal moment as analysts clash over Bitcoin's potential peak. Veteran trader Peter Brandt posits a 30% chance the top has already been reached, warning of a possible retracement to $60,000–$70,000 by late 2026 before a parabolic surge toward $500,000. His cautionary stance challenges bullish sentiment, suggesting markets may be prematurely discounting cycle dynamics.

Countering this view, Colin Talks Crypto identifies a lengthening cycle pattern—each bull run extending roughly four months beyond the last. His model projects a December 2025 peak, three years after the November 2022 trough. This technical outlook implies sustained upward momentum, with the current cycle potentially spanning 37 months versus prior durations of 24–33 months.

Analyst Predicts Bitcoin's Next Potential Peak in October 2025 Based on 35-Month Cycle Rhythm

Independent analyst Colin Talks Crypto has identified a recurring 35-month pattern in Bitcoin's bull-market cycles, suggesting the next peak could arrive around October 2025. By measuring advances from bear-market lows across three cycles, he found near-uniform timing—37, 35, and 35 months respectively—when using an unconventional but consistent methodology that treats the 2010 low as Cycle 1's start.

The current cycle, counting from November 2022's trough, would align with this template. Colin emphasizes diminishing returns as a caveat: each cycle's percentage gain has historically been smaller than the last. His timing-based approach diverges from conventional halving or macro-focused models, offering a purely structural lens.

BTC Daily Cash Out! —RICH Miner Launches High-Yield Cloud Mining App

Bitcoin (BTC), the world's leading digital asset by market capitalization, reached a new peak in 2025, solidifying its transition from a 'store of value' to a high-growth asset with sustained returns. Institutional demand and investor appetite are driving innovation in BTC yield generation.

Rich Miner's cloud mining platform emerges as a solution for investors seeking daily income streams from Bitcoin holdings. The service leverages BTC's global liquidity and network security to offer passive returns—a departure from traditional buy-and-hold strategies.

Cloud mining represents an evolution in Bitcoin utility, transforming the asset into both a capital appreciation vehicle and cash flow generator. Rich Miner's low-barrier platform aims to democratize access to mining rewards without hardware requirements.

Norway’s $1.7T Wealth Fund Expands Bitcoin Holdings by 83% in Q2

Norges Bank Investment Management, overseeing Norway’s $1.7 trillion sovereign wealth fund, significantly increased its Bitcoin exposure through investments in Strategy (formerly MicroStrategy) and Metaplanet. Holdings surged from 6,200 BTC to 11,400 BTC in three months.

Standard Chartered’s Geoffrey Kendrick noted the fund’s growing confidence in Bitcoin as a treasury asset, despite its modest proportion relative to total assets. The move reflects broader institutional adoption during the current market cycle.

Mexican Billionaire Ricardo Salinas Pliego Considers All-In Bitcoin Bet

Ricardo Salinas Pliego, one of Mexico's wealthiest entrepreneurs with a net worth exceeding $5 billion, is making waves in financial circles with his unorthodox investment strategy. The staunch Bitcoin advocate revealed in a May interview that he's contemplating shifting his entire fortune into the cryptocurrency, dismissing traditional stocks as "irrationally valued."

Salinas maintains only nominal exposure to gold and Bitcoin mining stocks, reserving his conviction for BTC itself. "Current stock valuation methods are very strange," he cautioned, urging portfolio managers to exercise extreme care in today's markets. This radical approach from such a prominent figure underscores the growing institutional acceptance of cryptocurrency as a legitimate store of value.

While financial experts warn of the risks inherent in such concentrated exposure, Salinas' move highlights a broader trend of high-net-worth individuals diversifying into digital assets. His public endorsement carries particular weight given his longstanding credibility in Latin American business circles and his avoidance of speculative positions.

Bitcoin Whale Awakens After 5 Years, Moves $353M in BTC

A dormant Bitcoin whale, identified by the wallet address "19D5J8," has reemerged after five years of inactivity. The entity controls 23,969 BTC, valued at roughly $2.82 billion, marking it as one of the original large-scale holders in the cryptocurrency space.

The whale transferred 3,000 BTC—equivalent to approximately $353 million—to a new wallet, triggering speculation among market participants. Such movements from long-inactive addresses often signal strategic repositioning or renewed interest from early adopters, potentially influencing market sentiment.

Historical data suggests that sudden activity from OG Bitcoin holders can precede volatility, though the intent behind this transfer remains unclear. The crypto community is closely monitoring whether this signals accumulation, distribution, or a cold wallet migration.

Bitcoin Faces Sharp Pullback After Briefly Topping $123,000

Bitcoin's price retreated sharply today after briefly surpassing $123,000, triggering over $800 million in long liquidations across cryptocurrency markets. The rejection from recent highs has analysts warning of near-term weakness, though the broader uptrend remains intact.

The world's leading cryptocurrency broke above a major horizontal resistance level before encountering heavy selling pressure. This reversal sent prices back toward the mid-point of the trading range - a critical level traders are watching to gauge the rally's sustainability. "The market absorbed liquidity above recent highs and quickly rejected," observed one analyst. "Greed was evident, and traders failed to take profits at resistance."

While Bitcoin maintains its higher timeframe uptrend, the one-hour chart shows the first lower low in weeks - a potential sign of shifting short-term momentum. Key technical levels include resistance at $120,000 (marked by the value area high and anchored VWAP) and support between $116,000-$117,000, where multiple technical factors converge including Fibonacci levels and the 200-day moving average.

Bitcoin Holds Steady While Hash Rate Climbs to ATH; $125K Target Imminent After Breakout

Bitcoin's price has entered a consolidation phase, holding steady after its strong rally earlier this year. This pause is typical post-rally, as traders take profits and await new catalysts. Consolidation often precedes major breakouts, making this a critical period for both short-term traders and long-term holders.

Meanwhile, Bitcoin's hash rate—the computational power securing the network—has surged to record highs. This divergence between price and network strength signals underlying optimism among miners, who tend to think long-term. Historically, rising hash rates follow price growth, as higher BTC valuations attract mining investment.

The resilience of Bitcoin's infrastructure, even during price stagnation, suggests institutional confidence in its future value. Analysts note that such periods of consolidation frequently culminate in significant upward movements, with some projecting a $125K target post-breakout.

Bitcoin Swift Crypto Presale Touts 100x Upside with AI-Powered Blockchain Features

Bitcoin Swift (BTC3) enters the crowded presale arena with bold claims of 100x returns, differentiating itself through a hybrid Proof-of-Work/Proof-of-Stake architecture and AI-driven smart contracts. The project promises instant Proof-of-Yield rewards at each presale phase—a departure from typical multi-year vesting schedules.

Its decentralized financial operating system integrates zk-SNARK privacy layers and a USD-pegged stablecoin collateralized by BTC3 tokens. Notably, the protocol incentivizes clean energy participation through AI oracles, addressing growing ESG concerns in crypto mining.

Fact Check: Google's $1.8 Billion Backstop of TeraWulf Sparks Bitcoin Mining Speculation

Google has entered the periphery of Bitcoin mining through a $1.8 billion financial backstop for Fluidstack, an AI cloud platform partnering with TeraWulf. The deal grants Google warrants for 8% of the publicly traded miner—not direct mining operations. This marks a strategic play in the converging AI and crypto infrastructure sectors.

TeraWulf's Lake Mariner facility will supply 200MW of computing power for Fluidstack's AI workloads. The transaction highlights institutional interest in Bitcoin-adjacent infrastructure rather than outright mining exposure. Market observers note the deal could signal broader tech industry recognition of crypto's energy arbitrage potential.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents a compelling investment opportunity with calculated risks:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20-day MA | 118,067 > 116,945 | Bullish momentum |

| MACD Histogram | -1440.3008 | Short-term bearish pressure |

| Bollinger Band Position | Middle → Upper | Consolidation phase |

| Institutional Demand | Norway +83% BTC | Long-term bullish |

John advises investors to monitor the $121,881 resistance level and MACD reversal signals for optimal entry points.